Actualité et presse

Documents téléchargeables

Scutum SF - PMPR - actualité des pays à risques - février 2026

Documents téléchargeables

Scutum Group - Annual Report 2024

Documents téléchargeables

Scutum Group - Annual Report 2023

Articles

Travailleur isolé : quelle est la définition ?

Articles

Réglementation Travailleur Isolé : quelles sont vos obligations ?

Articles

Téléphone PTI : que faut-il savoir ?

Articles

Dispositif homme mort : qu’est-ce que c’est ? Toutes les réponses !

Articles

Protection Travailleur Isolé : Qu’est-Ce Que C’est ?

Articles

Télétravail et protection du travailleur isolé : qu’est-ce qui change ?

Articles

Qu’est-ce qu’un DATI ?

Articles

En quoi consiste la maintenance d’extincteur d’incendie ?

Articles

Peut-on effectuer soi-même la maintenance des extincteurs ?

Articles

Fin de la 2G : Pourquoi et Quels Impacts ?

Articles

Fin des lignes RTC : Où en est-on ?

Articles

Montre PTI : le DATI discret et ergonomique

Articles

Bouton d’Appel d’Urgence IoT : le DATI Sans SIM et Sans Rechargement

Articles

Travail isolé et code du travail : jurisprudence pour défaillance d’assistance

Articles

Smartphone ATEX : Le DATI PTI Pour Environnement Explosif

Articles

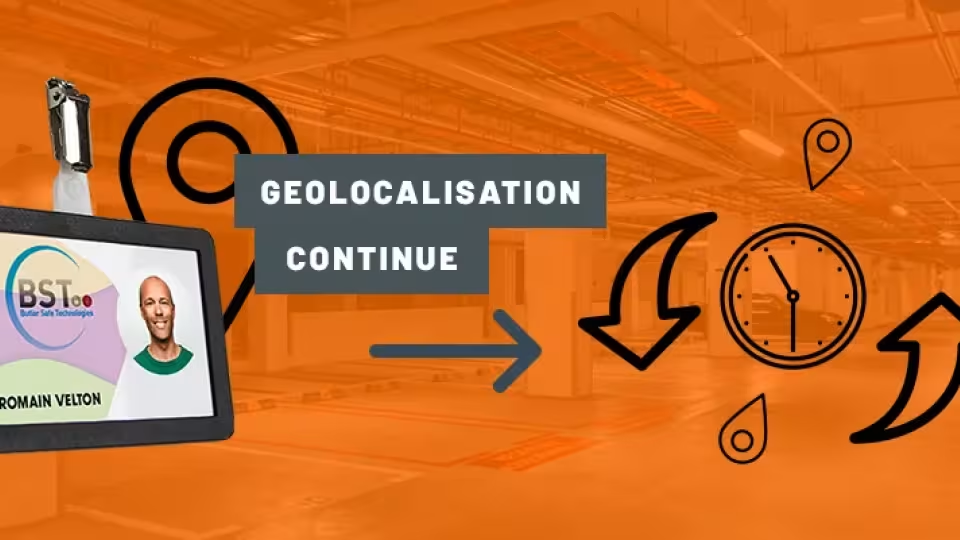

Qu’est-ce que la géolocalisation continue ?

Articles

Géolocalisation indoor : protégez vos travailleurs isolés là ou s’arrête le GPS.

Articles

Protection des travailleurs isolés – les enjeux

Articles

La maintenance des extincteurs est-elle obligatoire en France ?

Articles

Contrôle des extincteurs : quelle fréquence et pourquoi est-ce essentiel ?

Articles